Don’t Sell in Panic: The Night Gold Proved It’s the Real Insurance

Two nights ago, I was at my usual spot—my small home office with one flickering LED bulb, two monitors, and a cup of cold coffee that had lost its purpose.

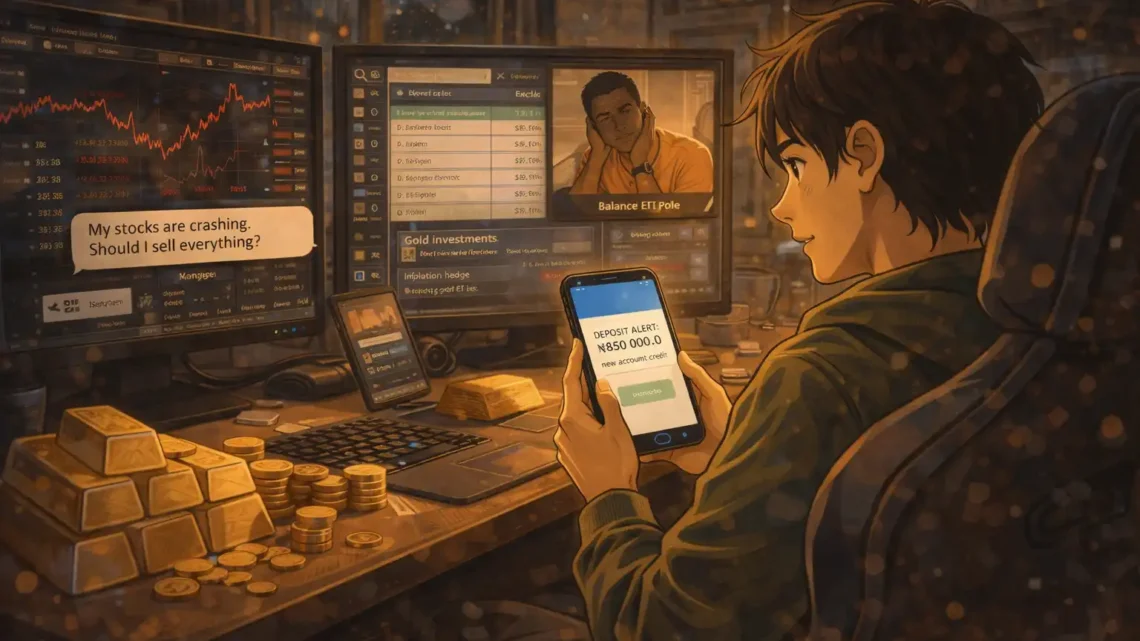

I had TradingView open on one screen, my stock trading app on the other, and a WhatsApp call ringing from my younger cousin, Zainab.

Trending Now!!:

I answered.

“Bro, are you alive?” she asked.

“Alive, yes. Calm, no,” I said, watching my stock portfolio bleed red.

That night, the market was behaving like Lagos traffic during rainfall—no logic, only chaos.

I’ve been investing in gold, stocks, and ETFs for over 10 years. I’ve seen bull markets, bear markets, flash crashes, and those fake rallies that give you hope before slapping you. But that night felt personal.

My phone buzzed again. It was a notification:

“Gold price hits new resistance level.”

I whispered, “Don’t play with me tonight, gold.”

Zainab laughed.

“You and your gold. Why not just put everything in crypto like normal Gen Z people?”

I leaned back in my chair.

“Crypto is vibes. Gold is insurance. Stocks are ambition. ETFs are peace of mind.”

She paused.

“That sounds like a caption.”

I wasn’t joking though. Gold investing has saved me more times than I can count. When inflation rises, when currencies wobble, when markets panic—gold just sits there like an old man that has seen everything.

But that night, my stock investments were sinking fast. Tech stocks down. Growth stocks bleeding. Even my dividend stocks were looking suspicious.

I opened my ETF portfolio.

Green. Calm. Balanced.

I smiled.

“ETFs, you’re the only emotionally stable thing in my life.”

Then my friend Kunle called. Kunle is the type that buys high and sells low, then blames “market manipulation.”

“Oga expert!” he shouted.

“Don’t call me expert when your portfolio is crying,” I replied.

“My stocks are crashing. Should I sell everything?”

That question has destroyed more investors than bad companies.

“Kunle, listen,” I said calmly, “you don’t sell in panic. You rebalance. You diversify. You remember why you invested.”

Silence. Then:

“So… no sell?”

“No sell.”

I told him what I was doing:

- Holding my gold ETF as a hedge against inflation

- Keeping my S&P 500 ETF because long-term growth never dies

- Cutting exposure from one overhyped stock I bought out of FOMO

- Adding to solid dividend-paying stocks

That’s real investing. Not vibes. Not hype. Strategy.

Suddenly, my power went out.

Darkness.

I laughed softly.

“Even NEPA wants me to reflect tonight.”

I switched to my phone and checked my investment app again. That’s when I saw it.

A deposit alert.

₦850,000.

My heart skipped.

It was from an old gold investment I had forgotten about. Ten years ago, I bought a small physical gold savings plan through a cooperative. I almost cashed out during a bad year but didn’t. I just let it sit.

It matured that day.

I whispered,

“Gold… you never disappoint.”

I called Zainab back immediately.

“Guess who just got paid for being patient?”

“Who?”

“Me and my boring gold investment.”

She screamed.

“Wait, so while your stocks were stressing you, your gold just saved you?”

Exactly.

That was the plot twist.

The thing I almost abandoned became the thing that rescued me.

Kunle called again.

“Oga, market is still red.”

I replied, “My account is green.”

He went quiet.

That night taught me what 10+ years in investing always teaches:

- Stocks build wealth

- ETFs protect sanity

- Gold protects survival

- And patience protects everything

I didn’t become rich overnight.

But I became stable. And stability is luxury.

I posted on my story:

“If your investments don’t let you sleep, you’re gambling, not investing.”

Zainab replied:

“Uncle Investor, teach me.”

I smiled.

Maybe this is how legacy starts.

Not with flexing.

But with calm money.