Debt Ceiling: Meaning, Deadline, Crisis, News, Update, Deal, History, Chart, Social Security

Definition

The debt ceiling, my friend, is a curious concept that affects a nation’s financial landscape in intriguing ways. It’s like a legal boundary, a cap on how much moolah the government can borrow to keep things running smoothly and meet its financial obligations. Think of it as a check on spending, a safeguard against excessive borrowing.

When a country hits that debt ceiling threshold, it’s like hitting a roadblock for the government’s credit card. They need to seek the approval of the powers that be to keep swiping it for more cash. It’s a nerve-wracking situation that forces the government to make tough choices—cutting back on spending, finding new revenue sources, or temporarily lifting that debt ceiling through fancy maneuvers.

Trending Now!!:

Let me tell you, this debt ceiling drama often turns into a political spectacle. The stakes are high, my friend. We’re talking about the government’s ability to pay its bills and keep essential services running smoothly. If the debt ceiling isn’t raised on time, it’s like playing a risky game of chicken with potential defaults on the country’s debts. That’s a major red flag for investors, leading to a loss of trust, soaring borrowing costs, and a potential economic downturn.

Managing the debt ceiling is no walk in the park. It’s a complex issue that requires a delicate balancing act. We need to fund government operations and investments while keeping a watchful eye on the nation’s long-term financial health. It’s like navigating treacherous waters, ensuring we don’t plunge into a financial abyss.

Ultimately, dealing with the debt ceiling calls for careful consideration of economic conditions, government spending priorities, and the overall financial well-being of the country. It’s like solving a puzzle, finding the right balance between meeting current obligations and maintaining a sustainable financial future.

The debt ceiling is the total amount of money the United States government can legally borrow. The debt ceiling was created in 1917 as a way for Congress to have some control over the government’s spending.

The debt ceiling has been raised or suspended 78 times since 1960, including most recently in 2021. When the debt ceiling is reached, the government can no longer borrow money to pay its bills. This can lead to a government shutdown when it cannot operate because it does not have the money to pay its employees or contractors.

Crisis

A government shutdown resulting from reaching the debt ceiling is no small matter. It has significant consequences that affect both the functioning of the government and the lives of its citizens. Imagine a sudden halt to the normal operations of the government, like a pause button pressed on the machinery of governance.

When the debt ceiling is reached, the government finds itself in a precarious position. It is unable to borrow more money to meet its financial obligations. As a result, certain services and programs deemed non-essential face the axe. National parks may close their gates, depriving nature enthusiasts of their beloved outdoor escapes. Passport and visa processing may slow down, causing frustration for those with travel plans.

But the effects go beyond these immediate disruptions. The financial markets, which thrive on stability and confidence, become jittery. Investors become wary, unsure of the government’s ability to manage its finances. This lack of confidence can lead to higher borrowing costs and tarnish the country’s credit rating. Economic stability is at risk, as businesses hesitate to make investments and consumers become more cautious with their spending.

However, it is not just the economic realm that suffers. The shutdown erodes public trust in the government’s ability to manage its affairs. People question the decision-making processes and wonder if their elected representatives have their best interests at heart. The ripple effects of this skepticism can be far-reaching, affecting public sentiment and participation in the democratic process.

In the face of such consequences, policymakers engage in a delicate dance of negotiation and compromise. They strive to raise the debt ceiling and find temporary solutions to keep the government functioning. The goal is to prevent a prolonged shutdown that would exacerbate the negative effects and deepen the sense of uncertainty.

As citizens, we have a role to play as well. We must demand responsible fiscal management from our elected officials and encourage bipartisan cooperation in times of fiscal crisis. It is essential to prioritize long-term financial sustainability and make decisions that will benefit both present and future generations.

The debt ceiling is not a mere technicality but a critical component of our nation’s financial stability. Its implications are felt by all, from government employees to businesses to ordinary citizens. Let us be vigilant, informed, and engaged, ensuring that our leaders navigate the challenges with wisdom and foresight. By doing so, we can mitigate the impact of a government shutdown resulting from the debt ceiling and safeguard the well-being of our nation.

Update

The debt ceiling, a perennial topic of discussion, has taken a temporary backseat. Effective from May 27, 2023, until January 1, 2025, it has been suspended, granting the United States government the ability to borrow without the looming threat of default. Congress, with bipartisan support, passed this suspension, and President Biden signed it into law.

Originating in 1917, the debt ceiling serves as a legislative tool to limit the government’s debt accumulation. Over the years, it has been raised or suspended on numerous occasions, often transforming into a political bargaining chip wielded by both parties.

This temporary relief brings a sense of reassurance to the economy. By avoiding default, we circumvent the disruptive consequences that could unsettle financial markets and hinder overall economic stability. Moreover, vital programs and services can continue receiving the necessary funding.

Nonetheless, the underlying issue persists. The debt ceiling remains a challenge, representing a self-imposed constraint that fails to fully reflect the complexities of America’s financial situation. As the government spends more than it generates, a future increase of the debt ceiling is inevitable. This will likely spur another political clash, leaving us uncertain about the resolution.

For now, let us appreciate the respite provided by the suspension. It grants the government valuable breathing space to address the fundamental problems that underpin the debt crisis. We must seize this opportunity to reassess, seeking sustainable solutions that align with our fiscal realities.

Pros

The debt ceiling, a topic that sparks intense debate, has its fair share of proponents who argue for its potential benefits. While these arguments may not be universally embraced, they shed light on some intriguing perspectives that deserve consideration within the larger economic landscape. Let’s delve into a few possible pros of having a debt ceiling:

- Fiscal Discipline: Proponents contend that the debt ceiling acts as a powerful tool to foster responsible fiscal behavior and prudent government spending. Imposing borrowing limits compels policymakers to scrutinize and prioritize expenditure decisions, ensuring that the government operates within its financial means and avoids reckless debt accumulation.

- Budgetary Vigilance: The debt ceiling compels regular reviews and assessments of the nation’s fiscal health. It prompts lawmakers to engage in robust debates and discussions about the country’s finances, leading to increased scrutiny of budget allocations and identification of potential areas of wastefulness or inefficiency.

- Public Awareness and Transparency: The debt ceiling debate brings the issue of national debt to the forefront of public consciousness. It serves as a potent reminder to citizens of their country’s fiscal challenges, fostering a more informed and engaged electorate. This heightened awareness stimulates conversations about the long-term economic consequences of mounting debt and the imperative for responsible fiscal policies.

- Constitutional Checks and Balances: Advocates argue that the debt ceiling upholds the system of checks and balances enshrined in the Constitution. By vesting Congress, as the legislative branch, with authority over the borrowing power of the executive branch, it prevents potential abuses or unchecked spending. The debt ceiling provides a platform for Congress to exercise its oversight role and ensure prudent fiscal decision-making.

- International Standing: Supporters contend that the debt ceiling signifies the government’s commitment to fiscal responsibility and willingness to address debt concerns. This demonstration of resolve can bolster the nation’s credibility in global financial markets, cultivating investor confidence and potentially leading to favorable borrowing terms.

Naturally, it’s crucial to recognize that the merits of the debt ceiling remain subject to ongoing debate, and valid counterarguments and criticisms exist. The effectiveness and impact of the debt ceiling should be evaluated in the broader economic context, taking into account potential drawbacks and unintended consequences associated with its implementation. A comprehensive assessment is key to fully grasping its nuanced role in the complex tapestry of fiscal policy.

Cons

When it comes to the debt ceiling, some voices raise legitimate concerns about its merits. Despite its intended purpose, they argue that this fiscal mechanism may bring about certain drawbacks that warrant careful consideration within the complex tapestry of economic dynamics. Let’s delve into a few potential cons of the debt ceiling:

- Turbulence and Market Jitters: The debt ceiling debate has a knack for instigating uncertainty in financial markets, igniting a fiery dance of unpredictability. Investors, being the cautious creatures they are, may become hesitant and adopt a wait-and-see approach. The mere possibility of a government default or disruptions in meeting obligations can give rise to heightened market volatility, impacting interest rates, investments, and overall economic growth.

- Political Logjam and Theatrics: The debt ceiling has morphed into a stage for political theatrics, with rival factions leveraging it as a potent tool to advance their respective agendas. This recurrent saga of partisan wrangling and political brinkmanship can lead to a prolonged impasse, shackling the timely resolution of pressing fiscal matters. Such protracted gridlock undermines public confidence, disrupts government functions, and casts a shadow of uncertainty on the economy.

- Default Dangers Lurking: By placing a legal cap on borrowing, the debt ceiling introduces the precarious specter of default. If breached, this proverbial dam could unleash a torrent of negative consequences. A default risks tarnishing the country’s credit rating, driving up borrowing costs, and eroding trust in the government’s fiscal management prowess. The potential economic fallout from such a calamity could extend far and wide, leaving lasting scars on the nation’s financial landscape.

- Disharmony with Fiscal Realities: Skeptics argue that the debt ceiling is a rigid constraint, ill-suited to align with the intricate tapestry of economic realities and the imperatives of responsible fiscal stewardship. It may shackle the government’s ability to meet its financial obligations, fund critical programs, or respond swiftly to unforeseen emergencies. This inflexible nature of the debt ceiling might hinder the prudent management of finances and compromise the flexibility needed for sound budgetary practices.

- Symbolic Showmanship: Critics contend that the debt ceiling’s significance lies more in symbolism than in substantial impact. Despite its ostensible role in curbing borrowing, it has frequently been raised or suspended, diluting its efficacy as a mechanism for fiscal discipline. This recurring pattern chips away at its credibility, raising pertinent questions about its meaningfulness in curbing the long-term growth of national debt.

It is imperative to consider these concerns and drawbacks alongside the arguments put forth by proponents of the debt ceiling. A comprehensive assessment and thorough evaluation of the potential negative ramifications are crucial in making informed decisions regarding fiscal policies. Only through such nuanced deliberation can we navigate the intricate landscape of the economy and ensure the nation’s overall well-being.

Importance Of Debt Ceiling

The debt ceiling is an intriguing piece of fiscal architecture that holds immense significance in economic governance. Though subject to diverse opinions, its presence carries a weighty purpose that cannot be dismissed lightly. Let’s delve into the nuanced reasons why the debt ceiling holds such momentous importance:

- Guardians of Fiscal Prudence: The debt ceiling assumes the honorable role of a fiscal custodian, safeguarding the nation’s financial integrity and sanity. By imposing a cap on borrowing, it acts as a prudent sentinel, warding off the perils of excessive spending and preventing the unfettered growth of insurmountable debt. It urges policymakers to approach budgetary decisions with judicious contemplation, paving the path toward a more accountable and thoughtful fiscal landscape.

- Sentinels of Creditworthiness: Ah, the treasured reputation of creditworthiness! A nation’s economic well-being hinges upon its ability to maintain a robust credit rating. Enter the debt ceiling, a knight in shining armor, guarding the sanctity of the nation’s creditworthiness. By signaling a commitment to responsible borrowing, it bestows upon investors the precious gift of confidence, ensuring reasonable borrowing costs and preserving the overall stability of the economy.

- Architects of Long-Term Financial Harmony: The debt ceiling assumes the mantle of an architect, crafting a blueprint for sustainable financial prosperity. Its presence curtails the unrestrained growth of national debt, an insidious beast that could wreak havoc on future generations. By erecting boundaries on borrowing, the debt ceiling urges policymakers to confront underlying fiscal challenges, nurturing a balanced approach that marries prudent spending with astute revenue generation.

- Balancing the Scales: Ah, the delicate dance of checks and balances! The debt ceiling is crucial in maintaining equilibrium between the executive and legislative branches of government. It affords a stage for congressional scrutiny and spirited debates on borrowing and spending policies. This theatrical performance ensures critical fiscal decisions receive the thorough examination they deserve, fostering a vibrant democratic dialogue.

- A Constitutional Sentinel: In many lands, including the illustrious United States, the debt ceiling is rooted in the constitution or statutory law bedrock. Its existence pays homage to the cherished principle of limited government, embodying the checks and balances intrinsic to the democratic tapestry. It humbly whispers that the power to incur debt should be subject to the hallowed halls of democratic deliberation and accountability.

- Steadying the Economic Symphony: The debt ceiling, a conductor in the economic symphony, harmonizes with financial markets and investors, offering a reassuring melody. Its presence serenades the senses, ensuring the government remains dutifully mindful of its fiscal obligations and committed to sound financial practices. This mellifluous tune engenders confidence in the economy, mitigating the risk of discordant market disruptions and beckoning domestic and international investments.

Ah, the debt ceiling is a complex interplay of fiscal guardianship, creditworthiness preservation, and democratic principles. Amidst the ebbs and flows of debate, let us remember its vital role in fostering fiscal responsibility, safeguarding the nation’s economic health, and nurturing a flourishing future. The symphony of fiscal prudence demands a delicate balance, and the debt ceiling, like a masterful conductor, guides us through this melodic journey.

Debt Ceiling Social Security

The paths of the debt ceiling and social security converge at a fascinating juncture, intertwining the intricate threads of fiscal policy and societal well-being. Let us embark on an illuminating exploration of this symbiotic relationship, unearthing the nuanced significance that lies beneath the surface:

My dear interlocutor, the debt ceiling serves as a financial compass, a proverbial guardian of fiscal prudence that limits the government’s borrowing capacity. It is a metaphoric handbrake, an invisible force that checks the growth of national debt. But how does this intriguing mechanism intersect with the venerable domain of social security? Allow me to unravel this tapestry for you, revealing the enigmatic connections within:

- Funding Entanglement: Ah, behold the delicate dance of financial interdependencies! Social security, a cherished safety net for retirees, the disabled, and survivors, thrives on a complex interplay of funding streams. Its lifeblood is the payroll taxes that flow from hardworking citizens, nurturing the program’s sustenance. However, the debt ceiling casts a looming shadow upon this intricate ecosystem. When the nation’s debt flirts with the ceiling, it sends tremors through the financial realm, potentially disrupting the flow of funds to vital programs such as social security. This can sow uncertainty and challenge meeting the program’s noble commitments.

- Political Intrigue: Ah, the hallowed battleground of politics! The debt ceiling has become an arena where ideologies clash, a theater of negotiations where partisan swords are brandished. In this political tapestry, the fate of social security hangs delicately in the balance. The ebb and flow of political tides, maneuvers, and posturing can create an air of apprehension surrounding the program. The interplay between the debt ceiling and social security thus amplifies the urgency of finding bipartisan common ground, ensuring the stability and longevity of this essential societal pillar amidst the tumultuous fiscal storms.

- Economic Ripples: The echoes of debt ceiling debates reverberate through the caverns of the economy, sending tremors that reach far and wide. The uncertain specter of breaching the debt ceiling dances in the minds of market players, influencing interest rates, investor sentiment, and the overall economic equilibrium. These ripples, my friend, do not spare social security from their effects. As an integral part of the economic tapestry, the program’s health is inextricably linked to the broader financial landscape. Thus, the delicate equilibrium between the debt ceiling and social security demands a deft balance to maintain stability and safeguard the well-being of beneficiaries.

- Long-Term Stewardship: The entwining of the debt ceiling and social security beckons us to contemplate the grand tapestry of long-term sustainability. With the passage of time, demographic shifts, and evolving economic dynamics, safeguarding the future of social security becomes imperative. Addressing the challenges posed by the debt ceiling, implementing sound fiscal policies, and fostering an environment of responsible stewardship hold the key to fortifying the program’s longevity. By navigating the treacherous waters of fiscal prudence, we can nurture a resilient foundation for social security, ensuring its enduring vitality for generations to come.

In the denouement, the intricate interplay between the debt ceiling and social security unveils a captivating fiscal and societal interdependence saga. As we traverse the intricate labyrinth of fiscal responsibility, let us seek paths that honor the sanctity of social security while acknowledging the challenges posed by the debt ceiling. Through prudent financial management, political harmony, and a commitment to the well-being of our society, we can forge a future where the tapestry of social security remains resilient amidst the enigmatic currents of fiscal dynamics.

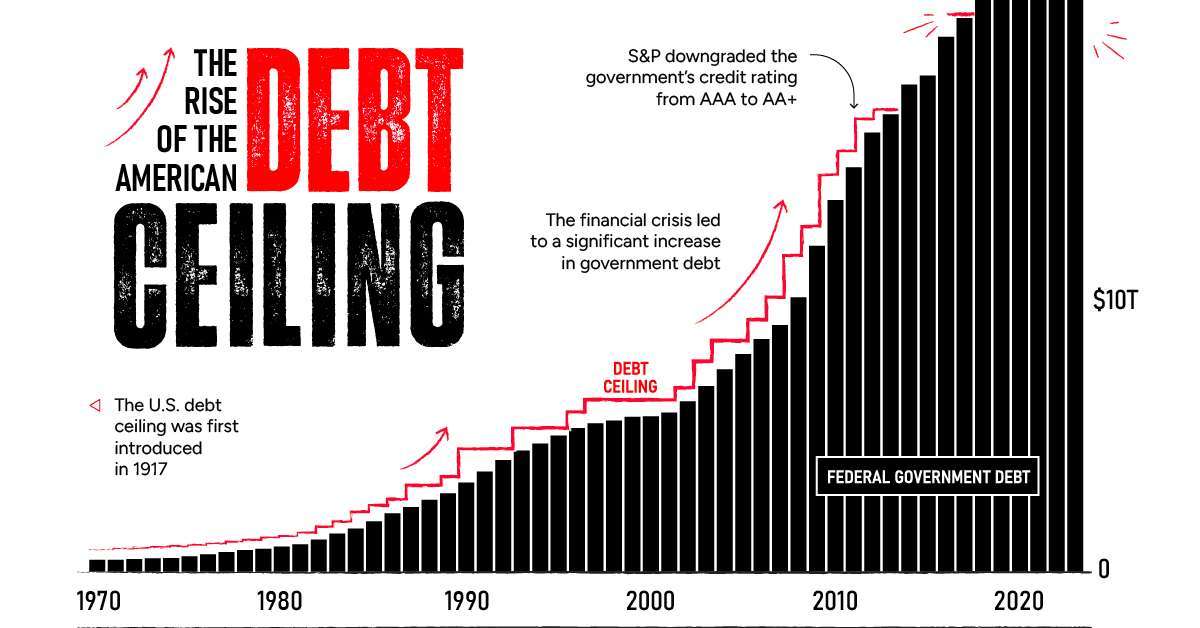

Debt Ceiling Chart

Let me take a moment to weave a tapestry of words that captures the essence of a debt ceiling chart. Prepare yourself for a journey through the realm of data, where lines and points intertwine to reveal a rich narrative:

Behold the enigmatic debt ceiling chart, a mesmerizing tapestry of numerical glyphs and plotted coordinates. Its intricate web of lines harbors a wealth of insights into the interplay between fiscal limits and political dynamics. Let us embark on a quest to decipher its cryptic language, delving into the depths of its visual poetry:

- The Grand Axes: Like the pillars of knowledge, the chart’s majestic axes emerge, each carrying weighty significance. The vertical axis, standing tall like a monolithic column, traces the ascent of the debt ceiling itself. It ascends with audacity, charting the ever-expanding borrowing bounds of our nation. Time, the relentless marcher, paints a chronological tableau on the horizontal axis, stitching together the fabric of fiscal history. Intertwined like cosmic dancers, these axes hold the key to understanding the debt ceiling’s evolution.

- The Dance of Peaks and Troughs: Across the chart’s sprawling canvas, a symphony of peaks and troughs emerges, reflecting the ebb and flow of the debt ceiling’s journey. These majestic peaks soar urgently, marking moments when the nation’s borrowing capacity reached its zenith. In contrast, the melancholic troughs represent periods of fiscal constraint and temporary relief. Together, they compose a delicate dance, mirroring the nation’s fiscal pulse.

- Inflection Points: The stars of the chart, those elusive inflection points that sparkle with significance. They mark the turning points, the pivotal moments in the debt ceiling saga. Each point whispers a tale of legislative battles, bipartisan compromises, or economic crossroads. These celestial signposts guide our understanding, unveiling the impact of decisions made, or unmade, at critical junctures. Their luminous presence invites contemplation, urging us to decipher the intricate interplay between politics and fiscal prudence.

- Unveiling the Narrative: A narrative unfolds as we immerse ourselves in the tapestry of lines and points. It tells a story of fiscal constraints, political wrangling, and the delicate balance between financial stability and national obligations. From suspensions that grant temporary respite to momentous votes that alter the course, the chart unveils a tapestry of compromise, conflict, and consequence. It reminds us of the intricate dance between fiscal responsibility and the exigencies of governance.

In conclusion, the debt ceiling chart emerges as a captivating tapestry of data, a testament to the ever-evolving nature of fiscal limits and political landscapes. Its grand axes, peaks and troughs, and shimmering inflection points beckon us to explore the intricate tapestry of fiscal decision-making. As we traverse its visual labyrinth, we gain a deeper appreciation for the nuanced interplay between economics, politics, and the imperatives of governance. So, let us embark on this intellectual odyssey, unearthing the hidden stories within the mesmerizing contours of the debt ceiling chart.