Crypto Made Me Broke… Then Taught Me Everything About Money

0 Posted By Kaptain KushThree months ago, I did something both bold and borderline stupid.

It was the end of the month. I had just gotten paid.

Trending Now!!:

- Finn Wolfhard Biography: Age, Movies, Tv Shows, Height, Net Worth, Parents, Instagram, Relationship, Wikipedia

- Connor Bedard’s mother, Melanie Bedard Bio: Age, Net Worth, Instagram, Spouse, Height, Wiki, Parents, Siblings, Children

- Dolly Parton Biography: Husband, Age, Songs, Net Worth, Children, Siblings, Movies

- Kimmo Timonen Biography: Stats, Age, Clubs, Salary, Net Worth, Wikipedia, Height, Weight, Awards, Wife

- Mingyu Biography: Songs, Parents, Age, Height, Instagram, Siblings, Education, Wikipedia

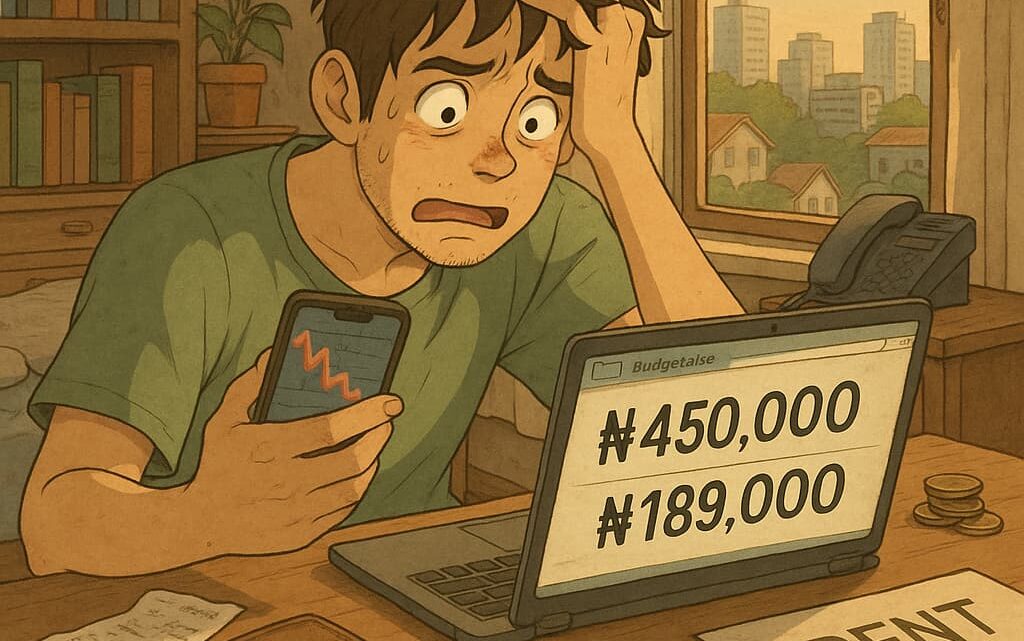

Rent was due, bills were stacking, and adulting was adulting. But instead of wiring ₦450k to my landlord, I moved the entire amount into Solana and a small-cap altcoin I’d been researching for weeks.

Why? Because I was “tired of being broke” and wanted to double my money fast.

Biggest red flag? I got the idea from a thread on X (formerly Twitter) that ended with “This is not financial advice.”

Anyway, my plan was simple: flip the investment in 10 days, pull out, pay rent late (but with extra cash), and maybe treat myself to shawarma or even an Airbnb staycation. Gen Z style, baby.

For the first few days, it actually worked. SOL jumped 8%, my altcoin was trending on Reddit, and I was already calculating my profits on Excel. I was even giving friends hot takes like, “you’re missing out if your money isn’t working for you.”

I felt like the Nigerian Warren Buffet. Only…with vibes.

But then came the twist.

On a random Tuesday, while I was at Chicken Republic celebrating my imaginary wealth, the market crashed. Hard.

A random crypto whale dumped millions of dollars’ worth of the altcoin, Solana followed suit, and just like that — I watched my rent turn into a glorified Pure Bliss biscuit.

In 45 minutes, my ₦450k became ₦189k.

I legit stared at my Binance screen like someone who saw JAMB results they weren’t expecting.

My palms were sweaty. I opened and closed the app five times, hoping the numbers would magically change. But no genie came. The market had spoken.

That night, I couldn’t sleep. I started thinking: What if I get kicked out? What if my landlord finds out I’ve been moonwalking with his money in digital Ponzi schemes?

I considered selling my gadgets. I even texted an ex who once said, “Let me know if you ever need anything.”

Worst part? I didn’t even make content from the whole drama. No vlog. No podcast episode. Nothing. Just raw financial pain.

The recovery?

Well, I got lucky. A freelance gig I’d pitched a month before came through with 300k. I sold my old iPhone for 120k. And somehow, I managed to piece together my rent — three days late — with only minor embarrassment.

But the lesson stuck.

Now, I’ve divided my finances into four categories:

- Essentials – Rent, food, transport.

- Emergency fund – No touching.

- Long-term investments – Index funds, stablecoins, and dividend stocks.

- Casino corner – A tiny wallet for all my degen moves.

Because yes, I still invest in altcoins. But only with money I’m emotionally okay to lose — like spare change or my gym subscription (which I haven’t used in six months anyway).

So yeah, if you’re reading this and considering flipping your school fees or rent in hopes of becoming a millionaire by weekend… don’t.

Or at least, record the chaos and go viral with it — so you’ll gain something.

Because, omo, crypto doesn’t love you like that.